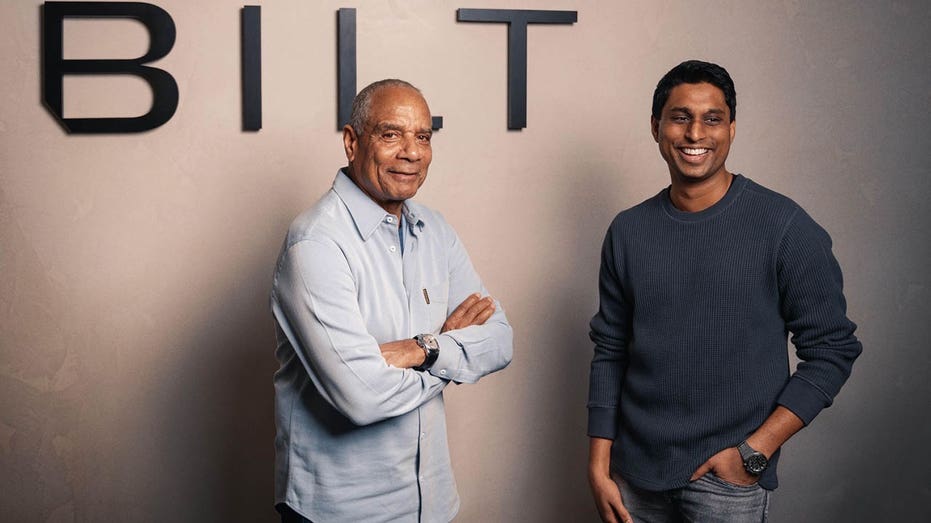

BILT founder and CEO Ankur Jain discusses the company’s valuation on ‘The Claman Countdown.’

Homeowners will soon have the chance to start earning rewards points for paying off their mortgage every month.

Bilt, a loyalty program designed to help members utilize their largest expenses for rewards points, is expanding its mission to make homeownership more attainable through a new partnership with United Wholesale Mortgage (UWM), the nation’s largest mortgage lender.

Starting in early 2026, UWM customers will be able to earn Bilt Points for every on-time mortgage payment, rewarding homeowners in the same way renters already earn points for paying rent.

Bilt CEO Ankur Jain said the new partnership with UWM will simplify the overly complex mortgage process by connecting members with local mortgage experts who can explain the real requirements and guide them through the process of qualifying for home loans.

NEARLY 1 IN 5 AMERICAN HOMES SLASH PRICES AS BUYERS GAIN UPPER HAND IN SHIFTING MARKET

“It’s so overwhelming and complex [the home buying process] that I hear over and over again… ‘it’s possible, it is too expensive,” Jain told FOX Business.

A shot of Bilt’s founder Ankur Jain and chairman Ken Chenault (Bilt)

FROM AMERICA’S ‘WORST MARKET’ TO WEALTH HAVEN: FLORIDA REAL ESTATE SPLIT SHOWS SIGNS OF LIFE

When it rolls out, which will occur in a phased approach, members with loans originated through UWM will earn rewards for every on-time payment. Just like other Bilt programs, those points can be redeemed for travel, dining, fitness classes, and even eligible student loan payments directly through the Bilt website or mobile app, which is free to join.

UWM CEO Mat Ishbia called the partnership a game-changer for the mortgage industry, especially at a time when potential buyers are contending with an affordability crisis.

A “for sale” sign is displayed in front of a house in San Francisco, California, on Aug. 19, 2015. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

“By integrating Bilt into our servicing platform, we are reimagining how a borrower views and thinks about their mortgage payments, while also creating an unmatched lead generation tool and exceptional client engagement for brokers,” Ishbia said, adding that “this will redefine industry standards, putting relationship-building at the center of mortgage servicing and elevate the wholesale channel to a new level.”

HERE’S HOW YOU CAN EARN POINTS WHEN PURCHASING A HOME

Since founding Bilt in 2021, Jain has worked to reinvent the path to homeownership by helping members use their biggest everyday expense to their advantage, earning rewards and building credit along the way. But Jain said this latest move marks a significant milestone in Bilt’s mission, noting that the question he hears most often is, “When can I earn rewards on my mortgage?”

After its founding, the company quickly gained recognition for helping renters earn points and rewards for paying their rent on time and for reporting those on-time payments to major credit bureaus to strengthen their credit profiles, making it easier to qualify for a future home.

It’s rapidly expanded since then, launching its neighborhood program about two years after its debut, which rewards members for spending at local restaurants, workout classes and through Lyft’s rideshare service. In 2024, Bilt partnered with Walgreens to help consumers use their flexible spending (FSA) and health savings accounts (HSA) for eligible purchases at the pharmacy chain.

HERE’S HOW YOU CAN EARN POINTS WHEN PURCHASING A HOME

It also launched a program last year that allows people to earn points when purchasing a home, as well as a search tool on its website and app that enables prospective buyers to search for homes based on their monthly budget rather than the total price. The idea is to help buyers navigate the complexities of homeownership in a way that aligns with their budget.

Homes in the Issaquah Highlands area of Issaquah, Washington on April 16, 2024. (Photographer: David Ryder/Bloomberg via Getty Images / Getty Images)

In April, Bilt expanded its rewards program, allowing members to redeem their points toward student loan payments through major servicers including Nelnet, Mohela, Sallie Mae, Aidvantage and Navient. Under the new option, every 1,000 Bilt points can be applied as $10 toward a student loan balance.

Through its partnership with American Campus Communities (ACC), one of the nation’s leading providers of student housing, Bilt members can earn points on their student housing payments while simultaneously building credit history.

#Bilt #partners #UWM #offer #mortgage #payment #rewards #points